Michelle O entourage takes 30 rooms at posh hotel...

First lady in $3,300-a-night suite...

17 Reasons the $17 Trillion Debt Is Still a Big Deal

Remember the debt? That $17 trillion problem? Some in Washington seem to think it’s gone away.

The Washington Post reported that “the national debt is no longer growing out of control.” Lawmakers and liberal inside-the-Beltway organizations are floating the notion that it’s not a high priority any more.

We beg to differ, so we came up with 17 reasons that $17 trillion in debt is still a big, bad deal.

1. $53,769 – Your share of the national debt.

As Washington continues to spend more than it can afford, every American will be on the hook for this massive debt burden.

2. Personal income will be lower.

The skyrocketing debt could cause families to lose up to $11,000 on their income every year. That’s enough to send the kids to a state college or move to a nicer neighborhood.

3. Fewer jobs and lower salaries.

High government spending with no accountability eliminates opportunities for career advancement, paralyzes job creation, and lowers wages and salaries.

4. Higher interest rates.

Some families and businesses won’t be able to borrow money because of high interest rates on mortgages, car loans, and more – the dream of starting a business could be out of reach.

5. High debt and high spending won’t help the economy.

Journalists should check with both sides before committing pen to paper, especially those at respectable outlets like The Washington Post and The New York Times. A $17 trillion debt only hurts the economy.

6. What economic growth?

High-debt economies similar to America’s current state grew by one-third less than their low-debt counterparts.

7. Eventually, someone has to pay the nation’s $17 trillion credit card bill, and Washington has nominated your family.

It’s wildly irresponsible to never reduce expenses, yet Washington continues to spend, refusing to acknowledge the repercussions.

8. Jeopardizes the stability of Medicare, Social Security, and Medicaid.

Millions of people depend on Medicare, Medicaid, and Social Security, but these programs are also the main drivers of the growing debt. Congress has yet to take the steps needed to make these programs affordable and sustainable to preserve benefits for those who need them the most.

9. Washington collects a lot, and then spends a ton. Where are your tax dollars going?

In 2012, Washington collected $2.4 trillion in taxes—more than $20,000 per household. But it wasn’t enough for Washington’s spending habits. The federal government actually spent $3.5 trillion.

10. Young people face a diminished future.

College students from all over the country got together in February at a “Millennial Meetup” to talk about how the national debt impacts their generation.

11. Without cutting spending and reducing the debt, big-government corruption and special interests only get bigger.

The national debt is an uphill battle in a city where politicians too often refuse to relinquish power, to the detriment of America.

12. Harmful effects are permanent.

Astronomical debt lowers incomes and well-being permanently, not just temporarily. A one-time major increase in government debt is typically a permanent addition, and the dragging effects on the economy are long-lasting.

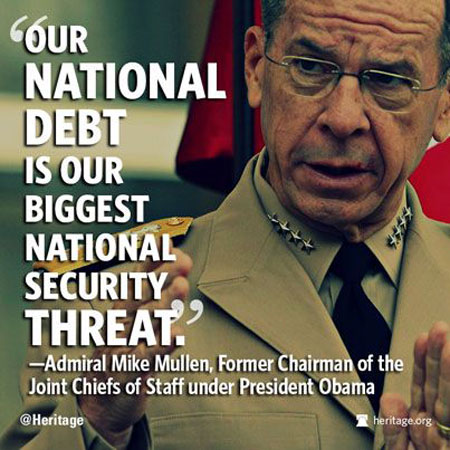

13. The biggest threat to U.S. security.

Even President Obama’s former Chairman of the Joint Chiefs of Staff thinks so:

14. Makes us more vulnerable to the next economic crisis.

According to the Congressional Budget Office’s 2012 Long-Term Budget Outlook, “growing federal debt also would increase the probability of a sudden fiscal crisis.”

15. Washington racked up $300 billion in more debt in less than four months.

Our nation is on a dangerous fiscal course, and it’s time for lawmakers to steer us out of the coming debt storm.

16. High debt makes America weaker.

Even Britain’s Liam Fox warns America: Fix the debt problem now, or suffer the consequences of less power on the world stage.

17. High debt crowds out the valuable functions of government.

By disregarding the limits on government in the Constitution, Congress thwarts the foundation of our freedoms.

http://blog.heritage.org/2013/06/17/morning-bell-17-reasons-the-17-trillion-debt-is-still-a-big-deal/?utm_source=Newsletter&utm_medium=Email&utm_campaign=Morning%2BBell

Yes, the “new and improved” farm bill is still chock-full of agribusiness pork

The politics of the now completely unnecessary and economically damaging raft of oh-so-generous subsidies, payouts, and programs that the federal government affords the agriculture industry became self-perpetuating long ago, and most unfortunately, neither the Senate-passed version of the current farm bill nor the one sitting before the House are any exception to that depressing and Depression-age rule.Supporting lawmakers and lobbyists are big fans of keeping both agriculture programs and food-stamps wedded into a single omnibus package, the easier to preserve the non-transparent nature of the whole things and throw in as many special projects and porkish handouts that they possibly can. The agribusiness lobby has evolved into a formidably powerful association with more than its fair share of political influence, and its ability to unite both Democrats and Republicans in the defense of special interests is really quite impressive; and you know the feds themselves are on board, because the Agriculture Department would be far less Busy and Important without so much taxpayer money to redistribute.

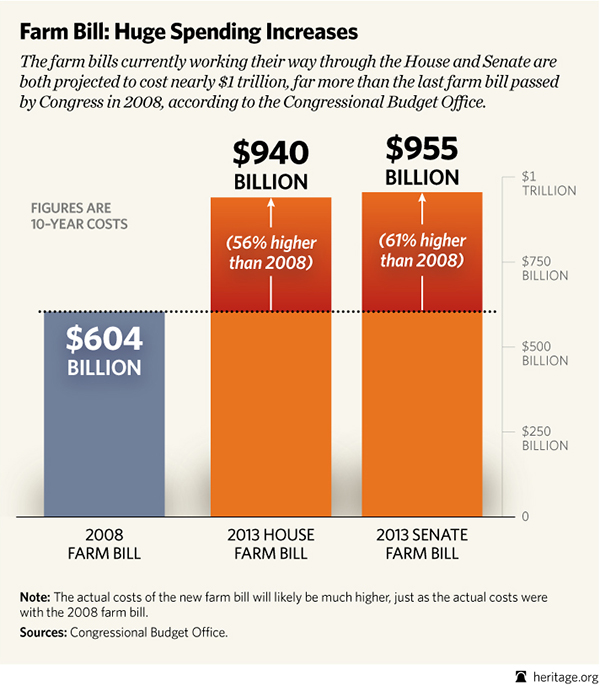

Proponents of getting these farm bills passed in are quick to point out that they are going to “save” taxpayers money by cutting out ten or twenty billion or so dollars from the budget over a decade — out of, you know, the trillion the farm bill is going to be spending over that same decade. As the Heritage Foundation points out, this is all a lot of hemming and hawing over what is a much more expensive bill than the last go-around, plain and simple:

What’s more, a lot of the much-discussed projections of savings are based on scenarios that may-or-may not materialize; Congress is looking to slim down the practice of the federal government making direct payments to farmers, because “direct payments” just sounds bad, but they’re instead going to be expanding government subsidized crop insurance to support and safeguard farmers’ incomes. It’s more of a kind of a six-of-one, half-dozen-of-another readjustment than it is a real, substantive reform, and plenty of highly niche interests are going to benefit from it as well as the many other special programs in the bills. As the WSJ points out, peanut, cotton, and sticky-rice farmers are going to be some of the big winners of the price guarantees in the bill:

The federal subsidy in the House bill guarantees farmers of Japonica Rice that if market prices drop below 115% of the average price of all types of rice, they will get a government payment to make up the difference. …

The move shines a light on guarantees against drops in commodity prices that are in some ways replacing the much-maligned direct payments to farmers Congress is seeking to end. Subsidies for products such as corn, wheat and cotton cost taxpayers about $5 billion a year. Rice growers have received a total of more than $2.6 billion in subsidies since 1995, according to the Environmental Working Group…

The sticky-rice provision won strong support from, among others, two Northern California lawmakers from neighboring districts, according to congressional aides and people working with the rice industry: Freshman Republican Rep. Doug LaMalfa, a fourth-generation Japonica Rice farmer who sits on the House agriculture committee; and Democratic Rep. John Garamendi, a rancher and pear farmer.Price guarantees, really? Heck, why don’t we just guarantee prices for gold, running shoes, and umbrellas, while we’re at it?

This behemoth and pork-filled bill is going to be directing a full decade’s worth of federal policy, but it’s going to fly on through under the radar to the tune of a trillion dollars paying for all kinds of miscellaneous programs, like expanding expanding broadband in rural communities and cleaning up the Chesapeake Bay; it’s nothing short of a raging party funded by the taxpayer’s dime, and everybody’s invited!

http://hotair.com/archives/2013/06/16/yes-the-new-and-improved-farm-bill-is-still-chock-full-of-corporate-pork/

Farm bill sends plenty of pork to the wealthy and well connected

It takes some doing to design a government program that harms the environment, fleeces taxpayers and consumers, and shovels money to some of the nation’s wealthiest families and corporations.The nearly $1 trillion farm bill — yes, trillion — that has passed the U.S. Senate and is headed to a possible vote next week in the House of Representatives does all this.

First, there’s environmental harm. This results from the outrageous crop insurance program, which most people outside agriculture probably believe pays for crop damage from hailstorms and other natural disasters. Crop insurance has instead become a revenue-protection program. The so-called Agriculture Risk Coverage provision works with crop insurance to guarantee farmers nearly 90 percent of their average revenue over the last five years. Prices the past few years have been at record highs, so if prices fall to more normal levels or crop yields drop, the declines in revenue will be covered.

In addition, the federal government provides huge subsidies — more than half of crop insurance premiums — for farmers to buy coverage, and further backstops the reinsurance of private companies that sell the insurance. Farmers armed with this cheap insurance take big risks, planting on marginal soils prone to erosion, flooding, or other problems, knowing if their gambles turn out bad, their losses will be covered. Such lands would be better left unplowed, reducing erosion and providing natural flood protection and habitat for plants and animals.

Second, the bill would fleece taxpayers and consumers. Those crop insurance subsidies and claims payments come courtesy of taxpayers. Americans also pay higher prices on food than they should. This happens in many ways. Here are just two examples:

1.) The U.S. has some of the highest sugar prices in the world because the farm program shuts out foreign competition. Thousands of jobs in the chocolate and candy industries have been moved overseas, where sugar prices are one-half or less what they are here.Third, the bill shovels money to wealthy families and corporations. Farmers with incomes above $250,000 make up about 10 percent of subsidy recipients yet receive one-third of the crop insurance money.

2.) The farm bill would extend a program that keeps milk prices artificially high by ordering production cuts when the government decides there’s too much milk on the market.

They don’t need this taxpayer support. Earlier this year the Agriculture Department’s Economic Research Service reported, “After adjusting for inflation, 2013’s net farm income, forecast at $128.2 billion, is expected to be the highest since 1973.” In that same announcement, the ERS reported, “Projected median total farm household income is expected to increase by 1.2 percent in 2012, to $57,723, and by an additional 1.9 percent in 2013, to $58,845.”

By comparison, “Real median household income in the United States fell between the 2010 American Community Survey (ACS) and the 2011 ACS, decreasing by 1.3 percent from $51,144 to $50,502,” according to the Census Bureau. The 2012 numbers are scheduled to be released in September.

These farmers include many members of Congress, such as Rep. Doug LaMalfa (R-Calif.), whose business has received more than $5 million in crop subsidies. There’s also Rep. Stephen Fincher (R-Tenn.), who has received nearly $3.5 million in subsidies.

The Heritage Foundation recently published an entertaining rundown, “The Rich and Famous at the Farm Bill Trough.” Consider this: “There are no farms in Manhattan, but residents there have collected subsidies totaling nearly $9 million in the past seven years. Recipients also include Mark F. Rockefeller ($356,018) and David Rockefeller ($591,057). Yes, the Rockefeller family (Standard Oil, Chase Manhattan Bank, etc.),” the report notes.

There’s more: “Over on the West Coast, in Beverly Hills 90210, the estate of comedian Jack Benny has collected $18,120 for a farm in Madera County, California, while $142,933 was paid to Mary Ann Mobley (Miss America of 1959) for a farm in Madison County, Mississippi.”

This money for the rich is the rule, not the exception, the report notes: “The USDA’s Economic Research Service reports that two-thirds of the farms with income exceeding $1 million annually received government payments averaging $54,745 in 2011. Meanwhile, just 27 percent of farms with income of less than $100,000 received payments — averaging just $4,420 in 2011.”

Of course, most of the so-called farm bill is really a food and welfare bill, as it funds food stamps and other nutrition programs. It includes measures to address fraud problems in those programs, and it does away with direct payments to farmers, but the games being played with crop insurance and other programs could more than make up for that revenue stream going away.

The farm bill caters to the wealthy and politically well connected. Sadly, this is in keeping with the tenor of the times.

Vacant Buildings Now Cost Half Billion Dollars Plus, But Who’s Counting? Not the Government

Two weeks ago I reported on the $250 million real estate boondoggle by the General Services Administration whereby the GSA is moving the Coast Guard out of an existing, below-market lease at the cost to taxpayers of $250 million dollars.Today I’m reporting on another, MORE EXPENSIVE real estate boondoggle by the GSA, which leads me to believe that if Congress is really serious about making real cuts to federal expenses that they can start with some easy cuts on federal real estate and personnel costs at the GSA.

That’s because according to the House Committee on Transportation and Infrastructure, the Nuclear Regulatory Commission, in collusion with our friends at the GSA, has ignored their “$38 million authorization by the Committee on Transportation and Infrastructure to lease 120,000 square feet for NRC projected employee increases, and instead [committed] to a lease for 358,000 square feet that is costing taxpayers $350 million.”

Talk about an increase in allowance.

Happy Father’s Day! Hey daddy, can I have $312 million…more?

More disturbing still is that the General Services Administration seems to have no fear that: 1) Misleading Congress, as is the case with the Coast Guard move, will get them in trouble; or 2) Spending a combined $600 million in vacant office space- that we know of so far- at a time when politicians are asking Americans to pay more in taxes, might cause some voters to rebel at the polls.

“The Subcommittee today questioned the NRC and the GSA about their plans to ensure the costs of their previous decisions are minimized,” said a statement released by the House Committee on Transportation and Infrastructure after both the NRC and the GSA appeared before the committee. “During questioning however, it became clear that neither agency had any specific plan in place to fill the NRC’s empty building space taxpayers are now paying for.”

Well at least that’s better than lying to Congress, which could be the less generous way of describing the testimony of the GSA on the lease that was broken by the agency on behalf of the Coast Guard.

As I wrote at the time: “The GSA has suddenly gone all ‘Eric Holder’ on Congress, testifying to the House subcommittee responsible for the oversight of federal real estate that the broken lease won’t cost taxpayers a dime, when in fact the opposite seems true.”

From the Washington Business Journal:

The federal government will be on the hook for at least $30 million in lease payments for the Coast Guard's current Buzzard Point headquarters after the agency moves to St. Elizabeths later this year, according to sources familiar with terms of the agency's lease with Monday Properties Inc.

That would contradict congressional testimony from Dorothy Robyn, public buildings service commissioner for the General Services Administration, who told a House subcommittee May 22 that the federal government has an early termination clause with Monday and will not owe any rent.

Sources say the Coast Guard is allowed to terminate its Buzzard Point lease in May 2015, meaning the government would have to pay the lease term until then. There remains disagreement over how much that exposure would be: Some sources say it would be $30 million, while others say it will be as high as $60 million.

That’s not just Contempt of Congress- or even perjury- that’s Contempt of Common Sense, Taxpayers, Economics and, most likely, at least a minor violation of Einstein’s concept of space-time.

In the best case, it seems, what the GSA is really saying is: “We aren’t liars per se, we’re just really incompetent.”

That’s not surprising, since it’s the standard patter coming from D.C. when anyone wishes to avoid responsibility, solutions, budget cuts or criminal charges.

Fortunately, the acting head of the General Services Administration, Dan Tangherlini, will appear before the Senate on Tuesday for confirmation hearings that one might suppose he hopes will make him the permanent head of the GSA.

Tangherlini, 45, was appointed 14 months ago to help clean up the GSA after a series of embarrassing revelations about mismanagement at the agency, which has seen it’s budget skyrocket from less than a billion dollars to close to $4 billion under Obama.

This will give U.S. Senators some time to separate the wheat from the chaff, so to speak, on reform of the GSA from the very guy now overseeing two notable screw-ups by an agency that influences budget matters for the entire government.

And they should demand some answers to some very tough questions, such as:

- Was Dorothy Robyn lying to Congress when she said that breaking the Coast Guard lease deal at 2100 2nd Street, SW, Washington D.C. would not cost the taxpayers money – when we all know there is a significant lease exposure?

- How much taxpayer money will be lost by keeping this building vacant? How much will be lost by paying for more expensive space elsewhere?

- If you are considering backfilling the space – why not keep workers there while enjoying the below market rates as long as you can? Does it make financial sense to move government workers twice between now and the end of the lease term? Is this about the PR battle, political points, or saving real dollars here?

- As Administrator of the GSA will you continue ignore leases that were negotiated to provide below market rates, in deference of more expensive ones?

- Are you troubled by this trend in light of the Nuclear Regulatory Commission recently committing taxpayers to a $350 million building it proposed to walk away from and let taxpayers pick up the tab?

At the very least, it will allow the voters to separate the rhetoric from the merely rhetorical.

And then vote accordingly.

http://finance.townhall.com/columnists/johnransom/2013/06/17/vacant-buildings-now-cost-half-billion-dollars-plus-but-whos-counting-not-the-government-n1621289/page/full

Republicans Get Played Again

Four weeks ago the College Board president David Coleman admitted he snookered Republican governors into accepting Common Core. In his May 17 presentation to education data analysts in Boston, the author of Common Core State Standards said:When I was involved in convincing governors and others around this country to adopt these standards, it was not 'Obama likes them'; do you think that would have gone well with a Republican crowd?

Even though the National Governors Association contracted Coleman's nonprofit Student Achievement Partners in 2007 to create the standards, by 2010, according to the Journal of Scholarship & Practice, the standards "had not been validated empirically and no metric has been set to monitor the intended and unintended consequences they will have on the education system and children (Mathis, 2010)."

Also in his speech, Coleman, in referring to the College Board, stated he has now brought on Obama's reelection team to develop his new Access to Rigor Campaign to collect and use data from students he calls "low-hanging fruit."

The College Board will use its existing and future data "vault" to profile low income and Latino students from K-12 using the slogan "If they can go, they must go" to college.

In order to pull this off, the architect of the Common Core literally begs his audience--data geeks "installed" within school districts and specialists from the Strategic Data Project which is based in Harvard's Center for Education Policy Research--to join him in finding these students and interacting with them throughout their classroom years.

Coleman's campaign is partnering with former Obama for America's Chief Analytics Officer Dan Wagner as well as a person Coleman references in his speech as "Jeremy" (could he mean Jeremy Bird also formerly of the OFA data analysis team?). With Obama's data gurus on hand, the Access to Rigor Campaign promises to be a broad national operation which will complement the massive Obama database already in use.

Coleman also mentions recently visiting with someone at the White House on the invitation of Wagner and others "because they saw that we're going to take the lead on this issue and they saw an opportunity for this country to get something done."

Eventually, the College Board will hand over its student data to research organizations like SDP, with restrictions on sharing information; but Coleman was not clear on how this would happen.

However, Coleman made it abundantly clear he will concentrate on data mining our schoolchildren's proclivities. So, how does intrusion into children's privacy through more accumulation of data support Coleman's stated goals of making students career and college ready?

Now that many states have awakened to the deficiencies in Common Core and are even moving to defund them, Republican governors who bought Coleman's spiel three years ago need to redeem themselves and investigate the nonprofit College Board's campaign to delve further into the personal lives of our schoolchildren.

http://www.theblaze.com/stories/2013/06/16/contradicting-irs-claims-d-c-supervisor-personally-scrutinized-tea-party-tax-exempt-applications/

U.S. Gov’t Spends $228K to Find Out Why Homosexuals in Kenya Avoid Free AIDS Treatment

The National Institutes of Health (NIH) has authorized a three-year study to find out why some HIV-positive homosexual men in Kenya do not seek the free treatment that American taxpayers already are funding.

The study, which will cost U.S. taxpayers $228,147, seeks to encourage Kenyan homosexuals, including prostitutes, to avail themselves of the AIDS treatment known as antiretroviral therapy (ART) – and to continue taking it once they start.

“Although men who have sex with men (MSM) are at very high risk for HIV globally, this group has only recently become an important focus of national HIV/AIDS programs in sub-Saharan Africa,” the project description says.

“While it is clear that antiretroviral therapy (ART) can reduce AIDS-related morbidity and mortality and prevent sexual transmission from HIV-infected MSM, little is known about antiretroviral adherence and barriers to care among African MSM.”

Researchers say they have worked with male prostitutes on the Kenyan coast since 2005 and have found “significant disparities” among people who seek treatment and continue with the therapy, partly due to “stigma and social isolation.”

The project, which began last month, plans to address the “treatment gap" by supporting African MSM as they begin treatment and by sending regular reminders to promote the continuation of anti-retroviral therapy.

Researchers say the project is “consistent with” priorities set by the NIH Office of AIDS Research on “reducing HIV-related disparities and improving disease outcomes for HIV-infected individuals.”

The study’s lead researcher, Dr. Susan Graham of the University of Washington, told CNSNews.com that antiretroviral therapy is free in Kenya, supported by PEPFAR -- the U.S. President’s Emergency Plan for AIDS Relief -- and other donor programs.

In fiscal year 2011, the U.S. government spent $517.3 million in U.S. taxpayer dollars to bring AIDS treatment free of charge to hundreds of thousands of Kenyans with HIV/AIDS. Between FY 2004 and 2011, PEPFAR funding for Kenya alone totaled almost $3 billion.

And that doesn’t include the tens of millions of dollars received from the United Nations, private donors, or the Kenyan government, which has made combating AIDS among high-risk populations—including homosexuals -- a top health priority for the nation.

According to Graham, the social stigma against homosexuality is a major barrier for HIV-infected men to seek treatment.

Asked about the study’s cost to American taxpayers at a time of tight budgets and mounting U.S. debt, Graham said she wouldn’t presume to get judge the government’s policy and budget choices.

“I do think Americans have an interest in supporting global health efforts worldwide,” she said, adding that the PEPFAR program has been a “huge success in terms of saving lives, promoting health, and fostering both good will and opportunities to improve health systems in the countries where it is active.”

According to the United Nations, approximately 1.6 million people in Kenya were living with HIV/AIDS in 2011, and 6.2 percent of the people 15-49 tested positive for the virus. An estimated 493,000 were receiving antiretroviral treatment.

The study, which includes investigators at the University of Washington, Kenya Medical Research Institute, University of Oxford, and Brown University, will rely in part on in-depth interviews and focus groups involving HIV-positive Kenyan MSM to find out why they might avoid treatment and what might change their minds.

“By involving MSM, Kenyan LGBT organizations, HIV care providers, and Ministry of Health representatives, we will ensure that the resulting intervention is feasible, acceptable, tolerable, safe, and ready to be tested for efficacy,” the project description says.

http://www.cnsnews.com/news/article/us-gov-t-spends-228k-find-out-why-homosexuals-kenya-avoid-free-aids-treatment#sthash.aTcHtXtk.dpuf

No comments:

Post a Comment